Hope Springs Eternal

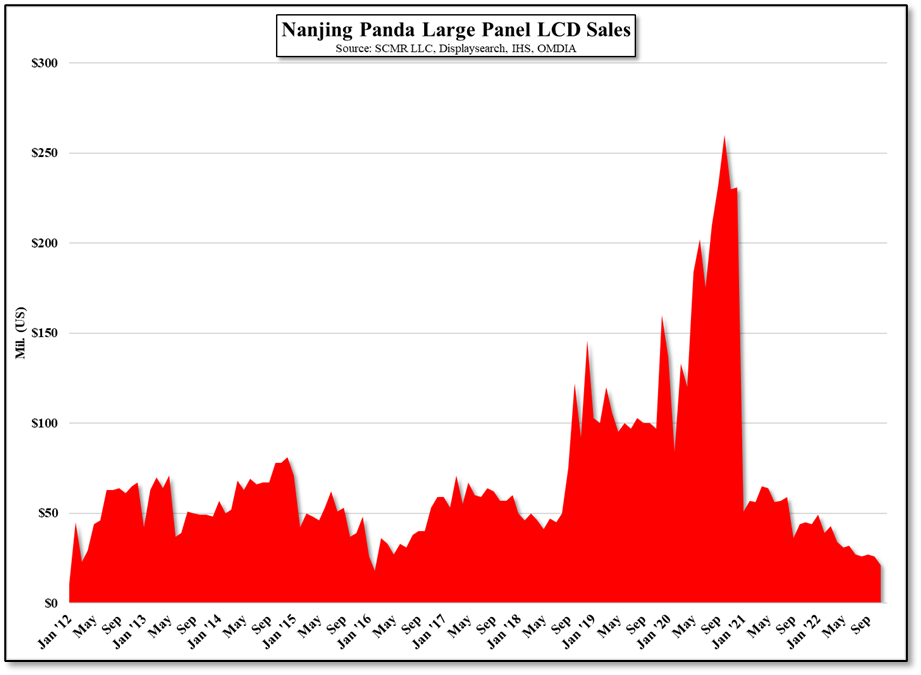

Our focus on Innolux is due to the fact that listed Taiwanese companies are required to release month results which gives a bit more color into CE display trends than typical quarterly results. While AU Optronics (2409.TT), the other major Taiwanese large panel supplier, we expect similar results as the display market heading into the Chinese New Year holiday was working toward continuing the reduction of inventory levels heading into 1Q ’23. As January and February are typically seasonally weak, we expect little change in February, with March usually the first positive m/m sales period.

As we noted previously, we expect large panel (TV) prices to remain stable or increase slightly over the next month, which could work toward a slight improvement in February results for display producers, but the question remains as to what drives TV set demand going forward, and for how long will panel producers maintain low utilization levels.. We expect little change in TV set or panel demand in 1Q, so the real question is whether display producer managements will cut prices again to stimulate 2Q sales. We expect that will not be the case, and managements will deal with 2Q results above those in 1Q but still lackluster and rely on 3Q to bail out the 2023 year, under the assumption that the global economy will have recovered enough to support a more positive holiday season. It is a lot to hope for, and there is much that needs to happen to make it work, but we are still quite early in the year which allows for that hope to remain alive.

RSS Feed

RSS Feed